Netflix (NFLX) – Get Netflix, Inc. Report stock is incredibly hot Wednesday, up a lot more than 5.5% as the bulls just take management and run the media-streaming important better.

As Covid-19 situations continue to be elevated close to the entire world and issue about the slide and winter seasons grows, Netflix shares are back again on the transfer bigger.

Netflix has been one particular of the top coronavirus plays in 2020, with the shares soaring 84% from their March lows.

Amazingly, that lags some of its other FAANG peers, like Amazon (AMZN) – Get Amazon.com, Inc. Report, Apple (AAPL) – Get Apple Inc. Report and even Facebook (FB) – Get Meta Platforms Inc. Class A Report.

Does that give the stock some place to the upside? If momentum continues, Netflix could effortlessly commence to perform capture-up into calendar year-conclusion.

How significantly? Pivotal Analysis elevated its price concentrate on on Netflix to $650 from $600, on account of a “virtuous cycle” of new subscribers and new written content.

Which is a self-assured get in touch with, presented that Netflix hasn’t yet hit $600. It continue to has one more 21% to go even soon after Tuesday’s transfer. Let’s glance at the charts.

Apple, Amazon and Facebook are holdings in Jim Cramer’s Motion Alerts As well as member club. Want to be alerted in advance of Jim Cramer buys or sells AAPL, AMZN or FB? Learn more now.

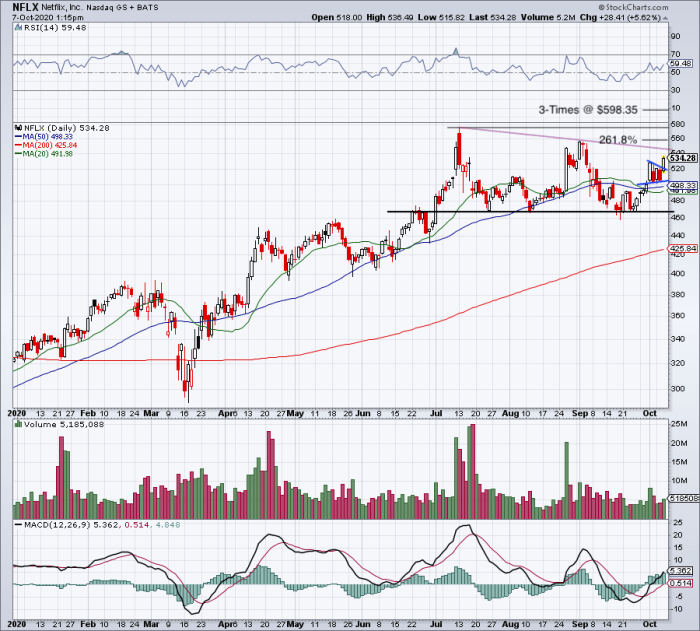

Buying and selling Netflix Inventory

Shares of Los Gatos, Calif.-based mostly Netflix were being taking pleasure in a couple of potent weeks of buying and selling, and they ramped into September.

But the stock ultimately logged a lower significant as the all round market place previous thirty day period arrived beneath noteworthy stress.

It was disappointing to see NFLX shares top rated out and reverse reduce, but on the moreover facet, vary guidance held firmly close to the $465 to $470 region.

On the ensuing rally, the shares reclaimed the 20-working day and 50-working day relocating averages ahead of flagging in a sideways pattern.

Even the market’s dip on Tuesday did not split this pattern. Now we’re observing a rotation out of this consolidation period. The shares are rotating around previous week’s significant at $529.55.

As lengthy as the stock retains up previously mentioned that degree, the bulls are in management in the shorter expression. From in this article, let us see whether downtrend resistance (purple line) plays any form of position. I’m aware of this degree, but I am not keeping it as the most crucial mark on this chart.

Alternatively, if the bulls continue on to thrust Netflix stock bigger, I want to see whether or not it can very clear final month’s superior at $557.39 and the 261.8% extension at $559.12.

Previously mentioned opens the doorway to the all-time substantial around $575, then the 3-moments selection extension all over $598.

If Netflix clears $600, it puts Pivotal’s $650 concentrate on on the table, which is just underneath the 361.8% extension in close proximity to $662.

On the downside, seem for a rotation below last week’s large. That will place the 20-working day and 50-day shifting averages in enjoy.

If the offering pressure pushes Netflix down below this place, then variety assist all around $470 is back on the desk.