Our US stock portfolio is made up of 15 index skims and 3 inventory picks. With regard to those index skims, remember to have a go through of Obtaining Dividend Growth Shares With out Searching.

Observe: Index skimming involves simply just getting plenty of individual corporations (constituents) from an index listing of holdings.

To be clear, I did not seem at the shares (I did no more investigation or evaluation) but the Dividend Achievers Index (VIG) undoubtedly did look. And it requires an extraordinary organization to make it into that index and ETF. The standards requires that a business have a background of escalating its dividend every single calendar year for 10 several years or additional the index also applies proprietary dividend health screens.

I bought 15 of the greatest cap constituents in early 2015, and proceed to keep all names. I did utilize a large cap bias to the portfolio development process.

The checklist of stocks has expanded to 17 firms many thanks to United Technologies. The enterprise merged with Raytheon (RTX) and that bundled the spin-off of Carrier World-wide (CARR) and Otis Around the world (OTIS). We hold all 3 businesses.

And when I publish ‘we’ – the organizations are held in my wife’s and my possess investment portfolios. I self-direct our retirement accounts.

For the purpose of evaluating the effectiveness of the inventory portfolio, I will use portfoliovisualizer.com. United Systems has been eliminated as the corporation proceeds as Raytheon. That usually means that United Technologies is not out there for historic returns. I will remove the firm from evaluation and operate the numbers with the remaining 14 stocks.

The shares in the US Portfolio

Right here are the index skims.

3M (NYSE:MMM), PepsiCo (NASDAQ:PEP), CVS Well being Company (NYSE:CVS), Walmart (NYSE:WMT), Johnson & Johnson (NYSE:JNJ), Qualcomm (NASDAQ:QCOM), United Systems, Lowe’s (NYSE:Minimal), Walgreens Boots Alliance (NASDAQ:WBA), Medtronic (NYSE:MDT), Nike (NYSE:NKE), Abbott Labs (NYSE:ABT), Colgate-Palmolive (NYSE:CL), Texas Devices (NASDAQ:TXN) and Microsoft (NASDAQ:MSFT).

After again, we will glance at the United Systems spin-offs in a different segment.

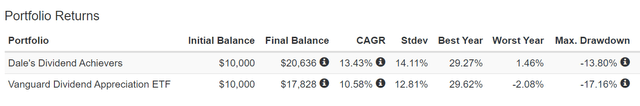

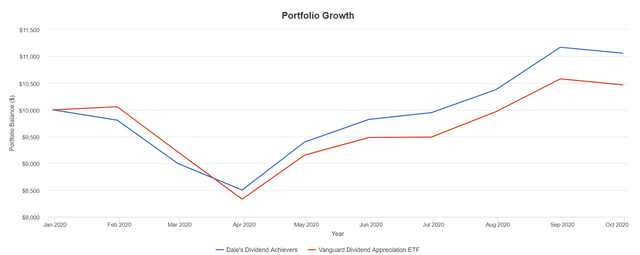

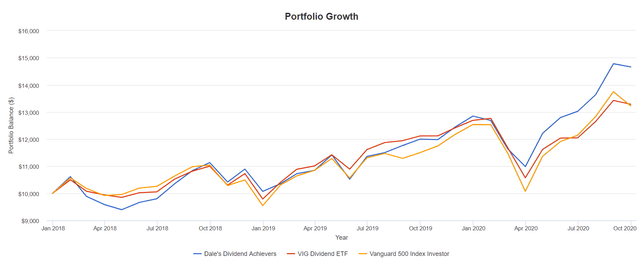

This is the effectiveness of the 14 Dividend Achievers (Dale’s Dividend Achievers) vs. the benchmark index – the Vanguard VIG ETF.

The period of time is January of 2015 to stop of September 2020.

For the higher than evaluation, we have an equal bodyweight commence with those people shares and we enable them operate, with no rebalancing.

We see that the bigger outperformance is thanks to the modern performance through market volatility and through far more making an attempt months for the inventory marketplaces. And that is solely the reason why I developed this portfolio. I was not anticipating any market place defeat, I preferred a portfolio that might hold up ‘better than the market’ in a significant inventory sector correction.

Mission attained so far, on that rely. And still we also see outperformance to the tune of 3% annual.

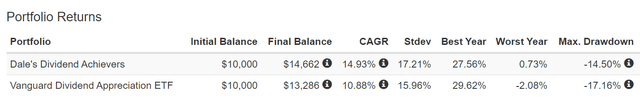

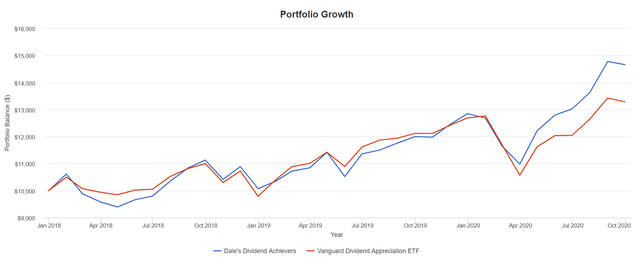

Returns from 2018.

Difficulties for the stock current market commenced in 2018. As you may well recall, we had a respectable calendar year in 2018 up right until the Xmas Crash.

In this article are the returns of the portfolio of Dale’s Dividend Achievers from 2018 to stop of September 2020.

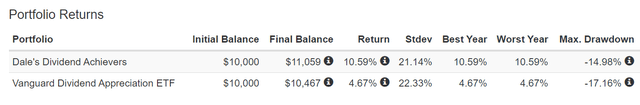

Calendar year to day.

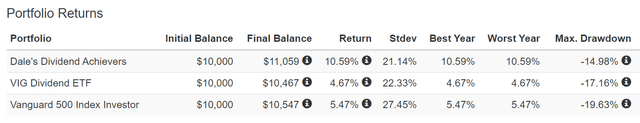

And here is the 3rd quarter report. This is year to date to stop of September 2020.

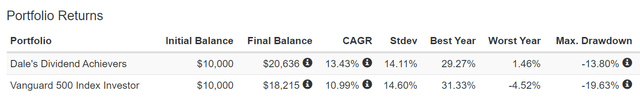

The Dividend Achievers vs. the S&P 500

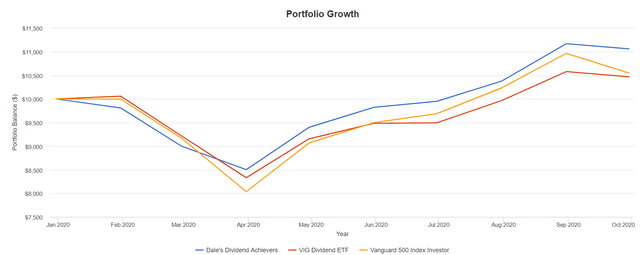

Here is a comparison for 2020 which includes the S&P 500 (IVV).

We can see that the current market (the S&P 500) has outperformed Vanguard’s Dividend ETF modestly in 2020.

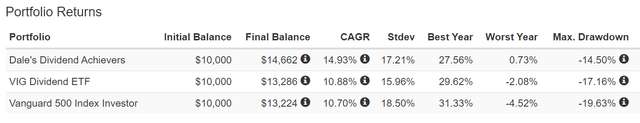

When we go back again to the beginning of 2018, we see a in the vicinity of attract between VIG and the IVV ETFs, but with that sizeable outperformance of the 14 Dale’s Dividend Achievers.

But the moment all over again (and as for every the bigger topic of much better hazard-adjusted returns), the Vanguard VIG experienced lesser volatility and lesser drawdowns in the period of time.

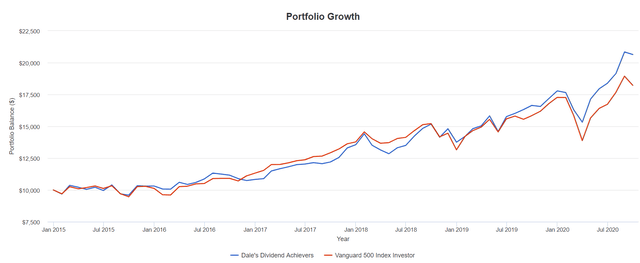

And of study course, I know you want to see Dale’s Dividend Achievers vs. the sector from 2015.

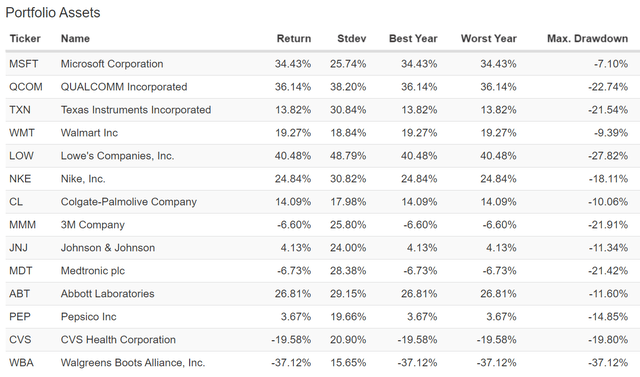

The specific stocks and functionality.

Here is the efficiency of the 14 businesses for 2020.

The portfolio is perfectly-positioned for the pandemic period of time. It is dominated by technological know-how, customer staples, consumer discretionary and health care.

CVS and Walgreens (however in the appropriate space) keep on to be the pet dogs of the portfolio. That explained, it is encouraging rather to have pet dogs that are making a good deal of revenue and paying out out very decent dividends.

My 3 US Inventory Picks

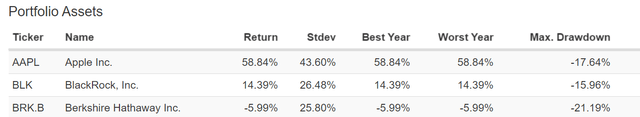

And yes, the tale gets even more encouraging. I have 3 US inventory picks. Here’s the effectiveness for 2020 to conclude of September.

Apple (AAPL) and BlackRock (BLK) are lengthy-phrase development picks.

Berkshire Hathaway (NYSE:BRK.A) (BRK.B) is a lot more of a recession hedge and a value ‘play’. Of course, Berkshire is not but functioning out as that recession hedge. But we could possibly be in the initially inning of that economic downturn (who is aware?) and Mr. Buffett is definitely not obtaining the US stock industry operate and US financial restoration ‘thing’.

In June, I wrote Warren Buffett does not get his prospect to be greedy.

I am a lot more than delighted to even now keep Berkshire as that hedge.

We are certainly not out of the woods however IMHO, and the virus has a lengthy way to go to operate its course. Economic realities are starting to settle in with layoffs and bankruptcies in numerous sectors this kind of as airways and tourism and movie theatres and dining places – a lot of are in really serious difficulties.

Abide by the virus

We do have to follow the virus, and the customer.

I do as well considerably reading on the pandemic and viruses and coronaviruses, vaccines and more. It can be very possible that it will acquire 2 to 5 many years for the virus to operate its course. At that level, it may well turn into the frequent cold, just like 4 other coronaviruses.

Mr. Buffett may possibly yet get his probability to be greedy.

Raytheon and United Technologies spin-offs

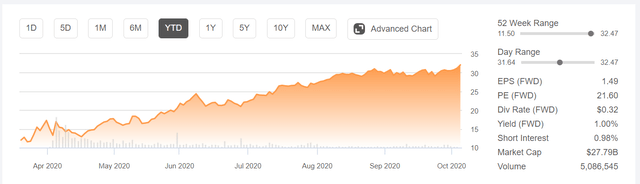

OTIS and Carrier have had an remarkable operate from the spin-off in March. Raytheon is up modestly from the spin-off.

I extra to Provider in April. Carrier was the 6th ideal-performing stock in the S&P 500 for the third quarter, up an remarkable 72%.

My TD Direct discounted brokerage report demonstrates that we are up about 64% for Provider from the March debut.

Here is the chart for Carrier from inception. Certainly, Mr. And Ms. Current market did not know how to assess this one particular from the preliminary spin-off.

I am more than pleased to keep this organization.

And all told, the United Technologies team have performed perfectly and would also have contributed a bit to the outperformance vs. VIG and IVV.

On the dividend entrance, we however have that best document for US and Canadian shares.

I am going to be back before long on Searching for Alpha with a glimpse at our Canadian portfolio and Canadian banks it is really the most inexpensive they have been in 20 decades.

We’ll see you in the remark part. How is your portfolio keeping up? Is your portfolio designed for the pandemic period of time?

If you favored this post, be sure to strike that “Like” button. Hit “Adhere to” to obtain notices of upcoming content.