Among March 23 and Aug. 1, the MSCI World Index surged 45%.[i] In the meantime, world-wide gross domestic item (GDP) was down sharply and unemployment was at traditionally high levels. How can the stock market climb although the U.S. economic climate is in a significant contraction and going through loads of political and geopolitical uncertainty?

The economic soreness and suffering tied to our latest financial contraction are true. Lots of men and women are out of perform, lots of businesses are in hazard of personal bankruptcy and towns across the place deal with sizeable finances shortfalls. And but, versus this stark backdrop, inventory charges march greater. Is this the signal of a world absent mad or of a new romance amongst the market and economic system? Need to we worry or cheer? Cease investing or acquire a lot more shares?

At Fisher Investments, we never believe that stocks’ recent increase is a signal of madness nor that it marks a new disconnect between the economic system and the inventory sector. Granted, COVID-19 has definitely available a lot of novelty. In just a number of months, it drove stocks from all-time highs into bear-marketplace territory, owing to the authorities-imposed economic lockdowns place in location to sluggish the unfold of the virus. Even though the historic particulars and the social and cultural context are new and unique, what is not new, in our feeling, is the possible for a longer time-phrase result.

The earth at present faces lots of challenges, but we feel the extended-time period economic prognosis is good, even with shorter-phrase uncertainty. For long-phrase traders, as we explain under, the apparent disconnect amongst the overall economy and the inventory current market seems like a typical phenomenon, as bull markets typically start out with jobless recoveries, only modest GDP growth and common investor pessimism. It may possibly look callous, but marketplaces can climb in spite of popular suffering prompted by regional conflicts, civil wars and even global pandemics.

Inventory Industry Selling prices in Probable Outcomes

We feel the ongoing restoration suggests the inventory sector is pre-pricing a brighter future exactly where the globe has moved further than the coronavirus or has discovered to control it so the economic system can continue being open and companies go on to run with some diploma of certainty. This may well appear odd, given the existing point out of the economic climate, but the stock market is ahead-looking and, ordinarily, shares get well in advance of a recession ends amid poor financial data and higher uncertainty.

Some investors fear a next or 3rd wave of coronavirus will scuttle the recovery, but we think this commonly talked about problem is most likely presently priced into the market place. When an uptick in circumstances is definitely lousy news from a community health and fitness standpoint, we consider it should not derail the new bull current market now underway — at minimum so extensive as it does not re-induce sweeping shutdowns or institutional closures. Considering buyers have extensive been mindful of the threat of a COVID-19 resurgence, we consider it would have to have to direct to new widespread closures and limitations, like we saw at the onset of the pandemic or even worse, in order to considerably have an effect on marketplaces.

Still, you could fairly inquire, what kind of financial ailments do we want to sustain the inventory sector recovery? Is the recovery on shaky ground? We don’t believe so and we demonstrate why down below.

Jobless Recoveries Are the Norm

Traders and commentators alike might concern that large unemployment makes the latest recovery unsustainable. But bull marketplaces usually start off when unemployment is even now higher — in some cases very significant — and stocks generally article considerable gains before the labor market place materially increases. At the commencing of the prior bull industry, unemployment peaked at 10.% in Oct 2009, whilst the stock market restoration started months previously in June.[ii] In 1982, a new bull marketplace commenced in August when unemployment was also previously mentioned 10%. Unemployment stayed earlier mentioned 10% right up until June 1983, almost a whole calendar year into the then new bull industry.[iii]

Large, even mounting, joblessness does not reduce turnarounds since they do not hinge on hiring. Turnarounds are generally pushed by business enterprise investment. New hiring follows from this, but does not lead.

Investors can Hitch Their Cart to Modest GDP Expansion

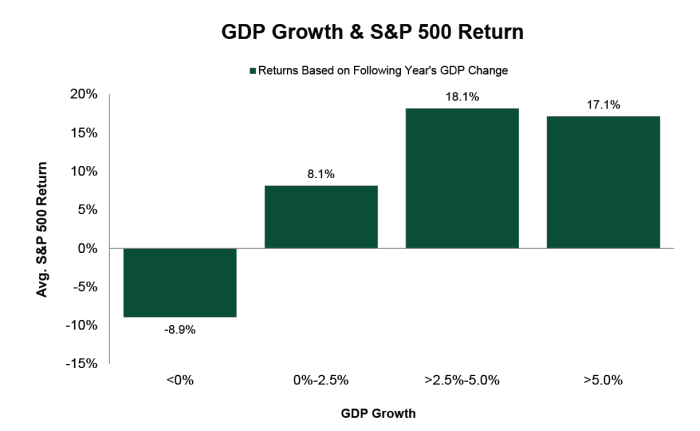

On the heels of a sharp decline in Q2 2020 U.S. GDP, buyers may possibly stress that the economy just will not be equipped to mature sufficiently to gasoline a restoration. Nonetheless, GDP is a lagging indicator and it ordinarily confirms a restoration after it has presently begun. Shares also never have to have runaway GDP advancement to post powerful returns. Buyers can profit even when financial progress is gradual. If you appear at stock market returns from 1970 to 2018 relative to the subsequent year’s GDP alter, you can see this fairly plainly. In a long time when GDP advancement was only in between % and 2.5%, stocks however posted typical yearly returns of 8.1% in the previous yr, as shown in the chart below. (Try to remember, stocks are discounting long term financial anticipations.)

Any Economic Growth Is Very good for Shares

Resource: FactSet Annually IMF IFS GDP Advancement, Serious Per cent Adjust – United States, 1970–2019 GFD S&P 500 Overall Return (gross), 1969–2018. Regular return within GDP progress increments.

This potential customers us to conclude this inventory market place restoration is much less fragile than quite a few presently think. It doesn’t will need 5% GDP progress or the unemployment rate to fall right away to 4% to keep on. It could just need things to be modestly greater than most assume.

New Bull Marketplaces Are Born on Pessimism

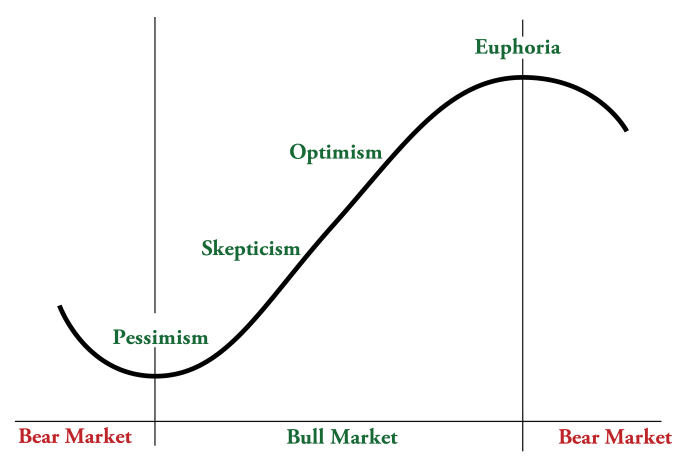

Quite a few traders are pessimistic proper now, but this is also normal at the begin of a bull market place. Famous investor John Templeton reported “Bull markets are born on pessimism, expand on skepticism, mature on optimism and die on euphoria.” Shares typically begin climbing though several investors continue to have a dour outlook. Templeton’s sentiment curve demonstrates how trader emotion tends to adjust in the course of the market place cycle and reminds us to be careful of building expenditure selections driven by emotion. Today’s pessimism also lowers the bar for news that creates favourable shock and pushes marketplaces greater.

John Templeton’s Sentiment Curve

While numerous investors continue to be pessimistic and see multiple explanations this bull market place could be derailed, we keep on being optimistic about the extended-term economic and sector outlook. Current fears that superior unemployment, lackluster GDP expansion or a COVID-19 resurgence will drag down markets are not new and probable already reflected in stock selling prices. The globe is much from best and uncertainty still swirls all-around how COVID-19 will engage in out, but if you wait for an all-very clear sign from the earth to spend (or reinvest, as the situation may perhaps be), the bull current market may well acquire off without you — costing you dearly in skipped returns.

Investing in inventory markets includes the hazard of loss and there is no promise that all or any cash invested will be repaid. Previous general performance is no promise of long run returns. Intercontinental currency fluctuations could result in a better or decrease investment decision return. This document constitutes the basic views of Fisher Investments and really should not be regarded as personalised financial investment or tax advice or as a representation of its effectiveness or that of its consumers. No assurances are manufactured that Fisher Investments will continue to keep these sights, which may alter at any time centered on new facts, investigation or reconsideration. In addition, no assurances are created relating to the precision of any forecast designed herein. Not all past forecasts have been, nor potential forecasts will be, as precise as any contained herein.

[i] Source: Factset, as of 08/25/2020. MSCI Entire world Overall Return Index, 03/23/2020–08/01/2020.

[ii] Supply: Federal Reserve Bank of St. Louis, as of 06/18/2020. Unemployment amount, Oct 2009.

[iii] Source: Federal Reserve Lender of St. Louis, as of 06/18/2020. Unemployment charge, November 1982.