More than half (54%) of insurers are not confident that the Covid-19 pandemic will be “over” by January 1, 2021, according to a survey from consulting firm Alan Walker LLC. As a result, all surveyed insurers said they have changed their business priorities in 2020 and 2021.

The survey polled 25 insurers across the property and casualty, life, and health categories between May 31 and June 11.

Approximately 38% of respondents said they were “not so confident” that the pandemic would be over by the end of the year, while 16% were “not at all confident.” Meanwhile, 8% were extremely or very confident that the pandemic would be over by January 1, while 38% were somewhat confident.

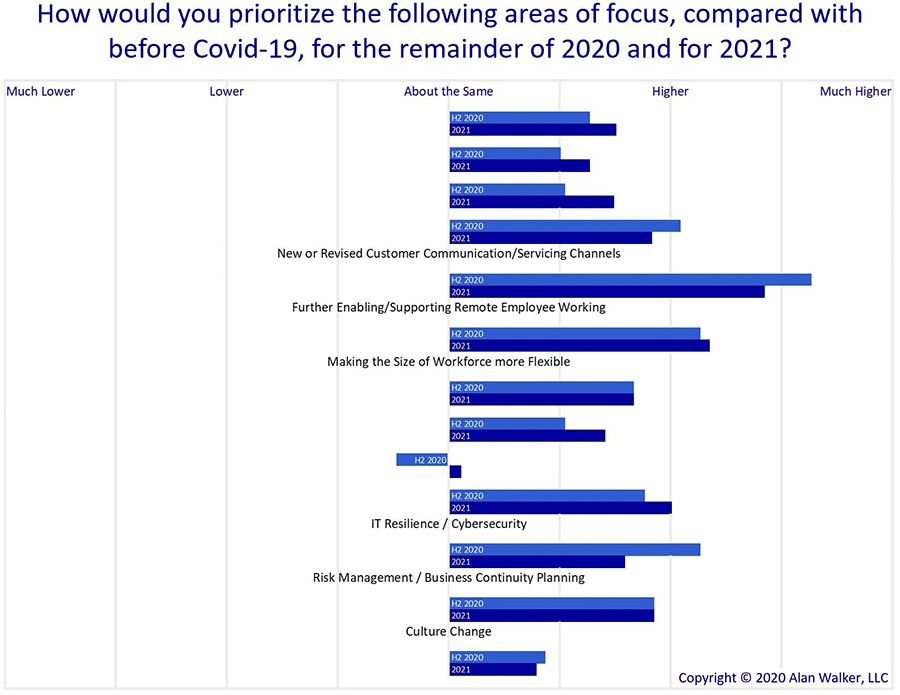

All insurers said they would be changing their business priorities in the second half of 2020 and in 2021. The areas selected to receive the greatest added focus were “enabling remote employee working” and “making the size of the workforce more flexible.”

In the insurance industry, as in many other office environments, the pandemic has proven that remote work is more feasible than many executives would have imagined. This has allowed many businesses to continue functioning in the lockdown period, which could not have been the case before robust internet connectivity. As the pandemic lingers and fears of additional waves continue until a vaccine is distributed (which could be years away), companies are reasonably assessing a longer-term transition to remote work and a reduction in commercial office space.

Meanwhile, companies across industries have had to deal with the workforce reduction aspect of “workforce flexibility,” whether that means hour reductions, pay cuts, furloughs, or layoffs. For a scant few, mostly in the area of e-commerce or food retail and distribution, workforce flexibility has meant a need for additional labor in the wake of increased demand.

The respondents also highlighted “new or revised customer communication/servicing channels” as receiving addition focus. With lockdowns, traditional bricks and mortar channels became a no-go, and shifting consumer preferences and behavior will result in many people avoiding non-essential, in-person contact. This means that insurers need to examine their distribution channel mix and potentially add further digital channels.

Servicing channels such as contact centers were overwhelmed during the initial parts of the crisis, so it may also be worthwhile to examine the mix of servicing channels to ensure they can better cope with potential future waves of the pandemic.

Insurers also identified IT resilience and cybersecurity as an increased priority. This is well-worn territory, as the pandemic has expanded remote work and the added cyber risks of remote connections to corporate networks. Companies need to make sure that their remote workers can safely and effectively do their digital work off-site.

“It is clear that Insurers don’t believe the pandemic will be over soon, and that they are changing their priorities significantly as a result. But with so many areas requiring increased focus, they are going to be busy. If Insurers are going to give these areas the attention they say they deserve, they are going to have to figure out how to do that without other areas suffering,” said Alan Walker, principal.

Alan Walker LLC is based in Chicago and delivers interim executive, advisory, and transformation services to US and global insurers. The consulting firm was founded in 2019 by seasoned industry consultant Alan Walker, who previously was EVP of digital insurance at Capgemini Consulting and a partner in the insurance sector at EY.